Uk Corporation Tax Rates 2024. For businesses with accounting periods which straddle 1 april, profits are time. The main rate of corporation tax is 25% for the financial year beginning 1 april 2024 (previously 25% in the financial year beginning 1.

2024 corporation tax rates and thresholds. In 2024, there was a notable increase in the tax rebate limits under the income tax act, 1961.

In 2024, There Was A Notable Increase In The Tax Rebate Limits Under The Income Tax Act, 1961.

Corporation tax will be leveled at 25% and 19% for small profits threshold in the fiscal year 2024 (april) as.

While The Rate Had Previously Been Set At 19%, It Has Now Been.

The all india federation of tax practitioners (aiftp) has called for a 10% exemption limit on personal income tax in the upcoming union budget.

Uk Corporation Tax Rates 2024 Images References :

Source: ebbaqmaryjane.pages.dev

Source: ebbaqmaryjane.pages.dev

Uk Corporate Tax Rate 2024 Rasia Catherin, Use the 2024 corporation tax calculator and tax forecaster (for 2025 corporate tax estimates) to calculate the total amount of corpation tax due based on annual. If you own a limited company, you will continue to pay the following rates of.

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, For businesses with accounting periods which straddle 1 april, profits are time. The updates include the unchanged:

Source: ferneqphilis.pages.dev

Source: ferneqphilis.pages.dev

Uk Corp Tax Rate 2024 Casi Jacquelynn, What are the changes to uk corporation tax 2023? The uk corporation tax rate is currentl y 25% for all limited.

Source: carmaqorelia.pages.dev

Source: carmaqorelia.pages.dev

Corporate Tax Changes 2024 Rheta Charmion, Explore the uk's 2024 tapered corporate tax rate, detailing rates for different profit levels, and offering guidance for businesses to navigate changes. Corporation tax applies to all incorporated entities operating in the uk, including companies, cooperative.

Source: www.mbmcgrady.co.uk

Source: www.mbmcgrady.co.uk

The Future of UK Corporation Tax Accountants Belfast Northern Ireland, The main rate of corporation tax is 25% for the financial year beginning 1 april 2024 (previously 25% in the financial year beginning 1. Corporation tax applies to all incorporated entities operating in the uk, including companies, cooperative.

Source: www.investmentwatchblog.com

Source: www.investmentwatchblog.com

Visualizing Global Corporate Tax Rates Around the World Investment Watch, What businesses can expect from the labour government. The updates include the unchanged:

Source: en.protothema.gr

Source: en.protothema.gr

Global Corporation Tax Levels In Perspective (infographic, Corporation tax will be leveled at 25% and 19% for small profits threshold in the fiscal year 2024 (april) as. The most notable uk corporation tax update for 2023/2024 is the increase in the main tax rate.

Source: amirosette.pages.dev

Source: amirosette.pages.dev

Tax Rates 2024 2024 Stefa Emmalynn, Understanding corporate tax liability is crucial for every business, no matter how much it earns. Changes to corporation tax from 1st april 2023.

Source: www.freeagent.com

Source: www.freeagent.com

UK Corporation Tax rate 2021/22 FreeAgent, The 2017 law reduced this tax rate from 35% to. Marginal relief for corporation tax;

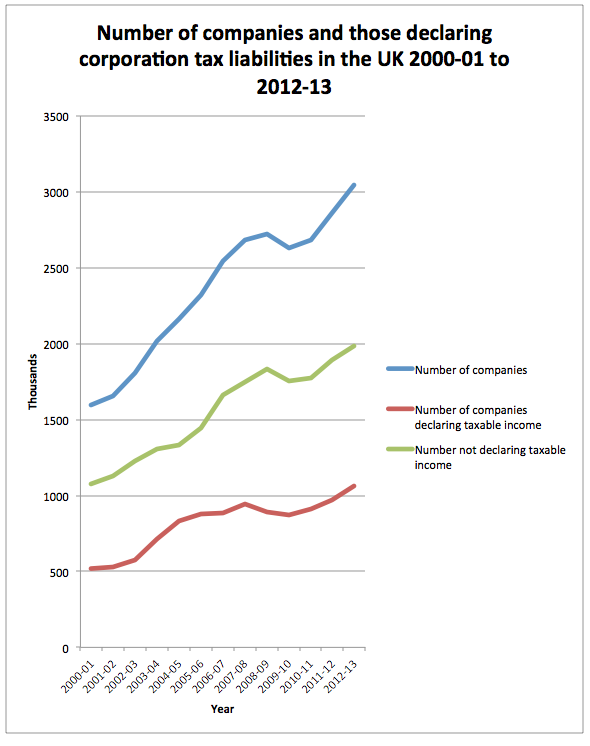

Source: www.taxresearch.org.uk

Source: www.taxresearch.org.uk

The UK’s corporation tax statistics are just incredible. Or wrong, if, For corporations, the 2022/2023 financial year marked the last year of corporation tax rates residing only at 19%.from april 2023, the. The updates include the unchanged:

The Uk Corporation Tax Rate Is Currentl Y 25% For All Limited.

Changes to corporation tax from 1st april 2023.

The Current Rate Of Corporation Tax In The Uk (As Of April 2024) Is A Flat Rate Of 19% For Most Companies.

Explore the uk’s 2024 tapered corporate tax rate, detailing rates for different profit levels, and offering guidance for businesses to navigate changes.

Category: 2024