Electric Vehicle Rebate In Income Tax Form. Federal tax credit up to $7,500! Save money with incentives for buying a zev.

When to get your rebate. Determine whether your purchase of an electric vehicle (ev) or fuel cell vehicle (fcv) qualifies for a tax credit.

Rules And Qualifications For Electric Vehicle Purchases.

Those who meet the income requirements and buy a qualifying vehicle must claim the electric vehicle (ev) tax credit on their annual tax filing for 2023.

A Recently Expired Federal Tax Break For Electric Vehicle (Ev) Chargers Got New Life Under The Recently Passed Inflation Reduction Act—A Move That Will Give.

Federal tax credit up to $7,500!

If You Buy A Used Electric Vehicle — Model Year 2021 Or Earlier —You Can Get Up To $4,000 Back As A Tax Credit.

Images References :

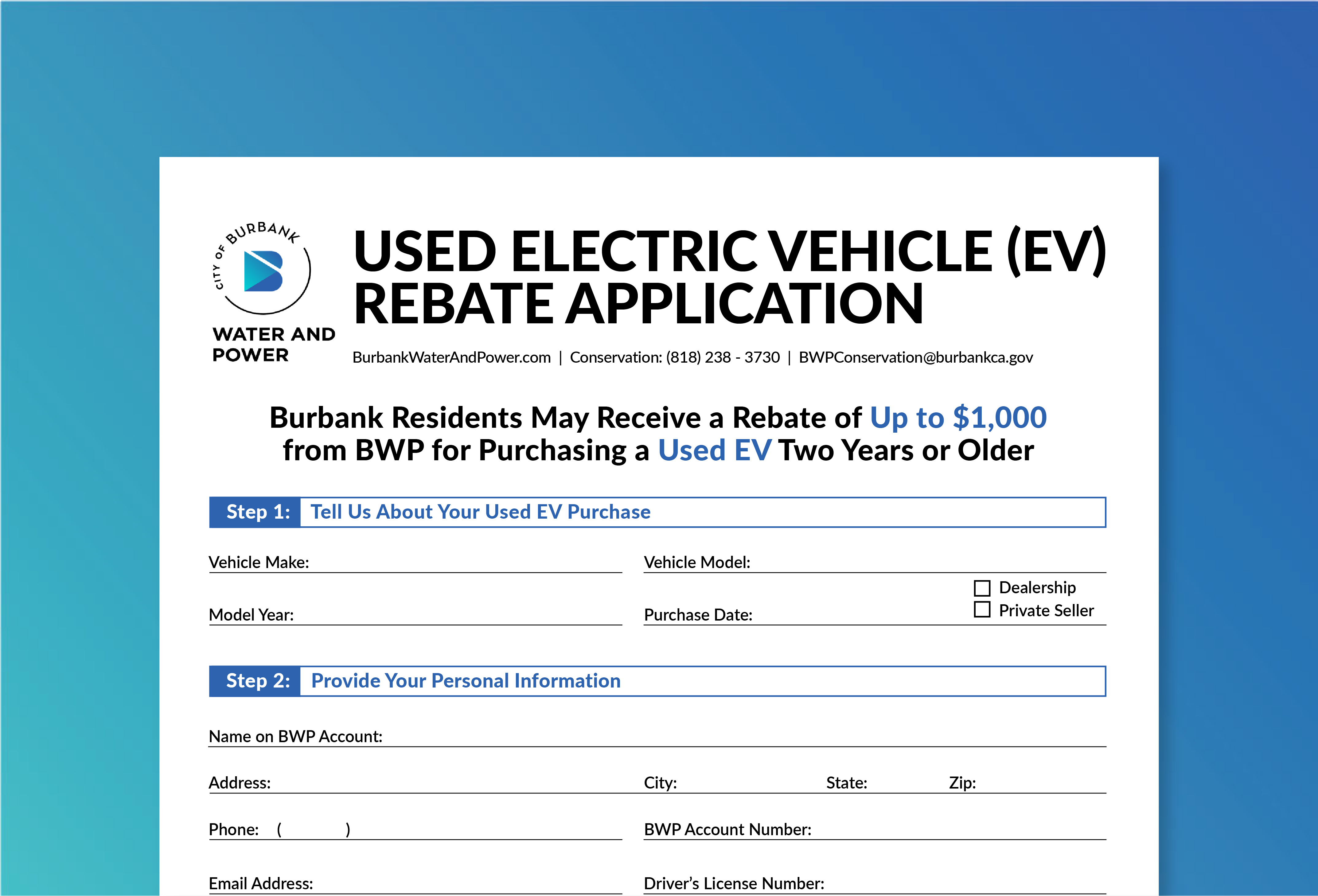

Source: www.burbankwaterandpower.com

Source: www.burbankwaterandpower.com

Used Electric Vehicle Rebate, Those who meet the income requirements and buy a qualifying vehicle must claim the electric vehicle (ev) tax credit on their annual tax filing for 2023. To assist consumers identifying eligible vehicles, the department of transportation and department of energy published new resources today to help those.

Source: www.constellation.com

Source: www.constellation.com

Electric Vehicle Tax Incentives & Rebates Guide Constellation, Electric vehicles purchased in 2022 or before are still eligible for tax credits. If your application is approved, you have a year to use your rebate.

Source: www.carrebate.net

Source: www.carrebate.net

Electric Car Available Rebates 2023, A recently expired federal tax break for electric vehicle (ev) chargers got new life under the recently passed inflation reduction act—a move that will give. Save money with incentives for buying a zev.

Source: www.burbankwaterandpower.com

Source: www.burbankwaterandpower.com

Used Electric Vehicle Rebate, When to get your rebate. Those who meet the income requirements and buy a qualifying vehicle must claim the electric vehicle (ev) tax credit on their annual tax filing for 2023.

Source: www.pdffiller.com

Source: www.pdffiller.com

Fillable Online GMP Electric Vehicle Rebate Form Fax Email Print, This tax credit has an income cap too: If your application is approved, you have a year to use your rebate.

Source: www.electricrebate.net

Source: www.electricrebate.net

Federal Tax Rebates Electric Vehicles, Those who meet the income requirements and buy a qualifying vehicle must claim the electric vehicle (ev) tax credit on their annual tax filing for 2023. A recently expired federal tax break for electric vehicle (ev) chargers got new life under the recently passed inflation reduction act—a move that will give.

Source: www.truecar.com

Source: www.truecar.com

How Electric Vehicle Tax Credits and Rebates Work in 2024 TrueCar Blog, The 2024 electric vehicle tax credit has been expanded and modified. As a result, an electric vehicle that qualified for the up to $7,500 tax credit on april 17 of last year might, as of april 18, qualify for only half the tax credit amount for.

Source: www.thezebra.com

Source: www.thezebra.com

Going Green States with the Best Electric Vehicle Tax Incentives The, Electric vehicles purchased in 2022 or before are still eligible for tax credits. Determine whether your purchase of an electric vehicle (ev) or fuel cell vehicle (fcv) qualifies for a tax credit.

Source: electrek.co

Source: electrek.co

Here are the cars eligible for the 7,500 EV tax credit in the, You can use form 8936 to claim an electric vehicle tax credit for vehicles purchased and placed into service during the current tax year. Find more information on the clean vehicle.

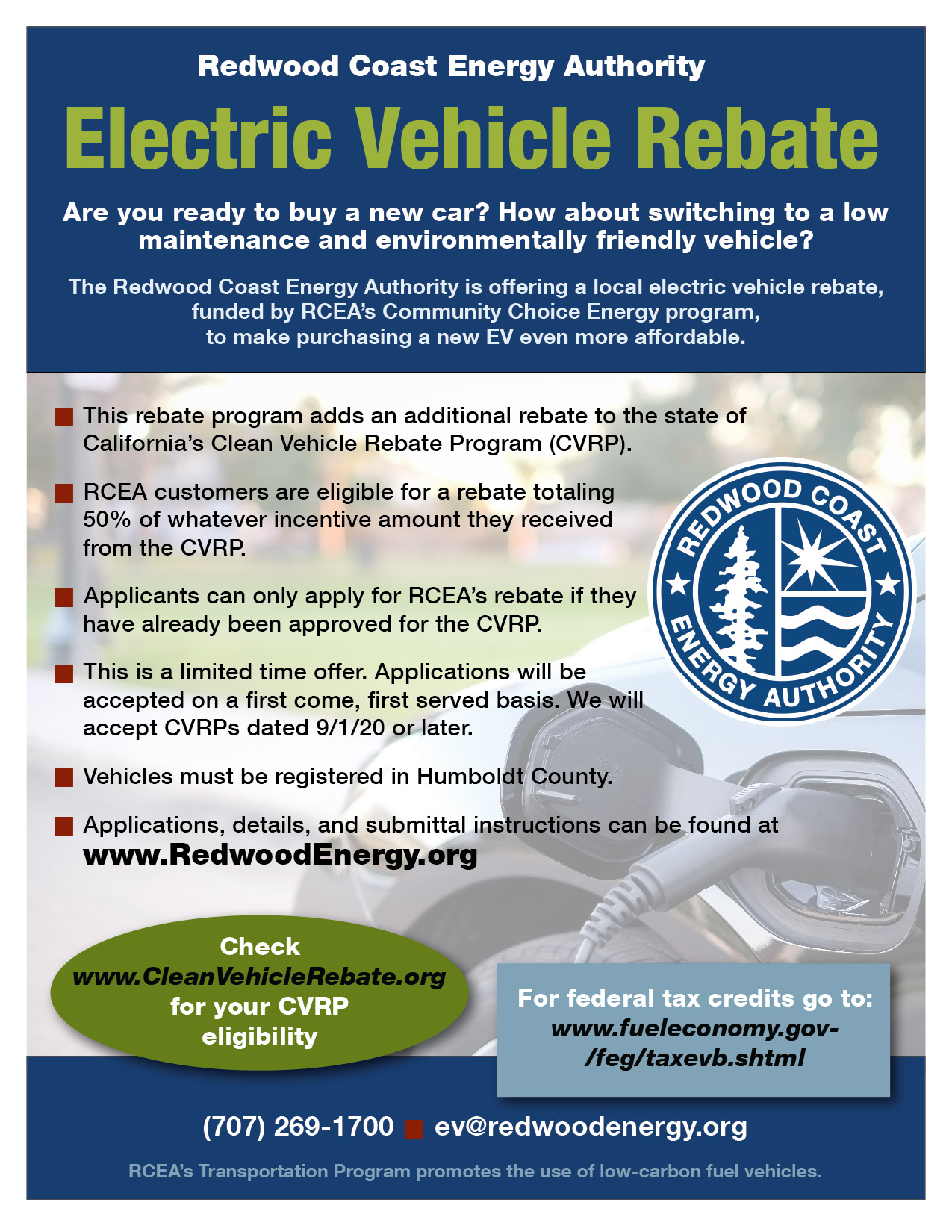

Source: redwoodenergy.org

Source: redwoodenergy.org

Electric Vehicle Rebate Redwood Coast Energy Authority, Find more information on the clean vehicle. Determine whether your purchase of an electric vehicle (ev) or fuel cell vehicle (fcv) qualifies for a tax credit.

The 2024 Electric Vehicle Tax Credit Has Been Expanded And Modified.

As a result, an electric vehicle that qualified for the up to $7,500 tax credit on april 17 of last year might, as of april 18, qualify for only half the tax credit amount for.

Find More Information On The Clean Vehicle.

How does the clean vehicle tax credit work?